Your Partner in Business Growth

Business Financing Solutions Tailored for Your Success

Stacd empowers businesses with flexibility, speed, and control they need to thrive in today’s fast-paced world. Through strategic partnerships, we provide access to innovative financial tools like Unsecured Business Lines (UBLs) and Business Credit Cards, helping you stay ahead in a competitive landscape.

The Business Credit Card Advantage

No Collateral Required

Enjoy unsecured credit without risking your personal or business assets. Keep your peace of mind while accessing the funds you need.

Instant Access to Funds

Say goodbye to long waits. Business credit cards provide immediate credit availability, enabling you to act quickly on opportunities or manage unexpected expenses.

Revolving Credit for Maximum Flexibility

Borrow as needed, repay, and reuse. This revolving line of credit is ideal for handling fluctuating cash flows or seizing short-term opportunities.

Reward Programs and Perks

Benefit from cashback, travel rewards, and exclusive perks that save money or support business travel expenses while funding your operations.

Simplified Management

Track spending, manage employee cards, and categorize expenses seamlessly. Simplify operations so you can focus on growth.

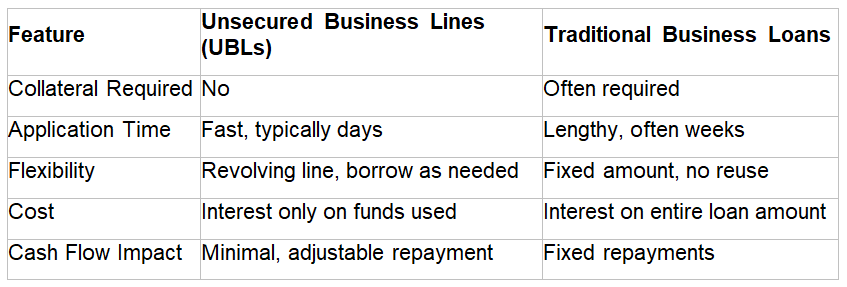

Why Unsecured Business Lines (UBLs) Outperform Traditional Business Loans

Flexibility You Can Rely On

- UBLs: Borrow exactly what you need and only pay interest on the amount used. Once repaid, your credit line replenishes, offering continuous access to funds.

- Traditional Loans: Fixed loan amounts and rigid repayment schedules limit your ability to adapt.

No Collateral Required

- UBLs: Access funds without risking your assets.

- Traditional Loans: Often require collateral, putting your property at risk.

Fast and Easy Access to Capital

- UBLs: Quick approvals, often within days.

- Traditional Loans: Lengthy applications and approval processes can delay funding.

Cost-Effective Borrowing

- UBLs: Pay interest only on what you use, making it an economical choice for businesses with variable funding needs.

- Traditional Loans: Interest accrues on the full loan amount immediately, regardless of usage.

Tailored Repayment Options

- UBLs: Adjustable repayment aligned with your revenue cycle.

- Traditional Loans: Fixed monthly payments can strain your cash flow.

Feature Comparison: UBLs vs. Traditional Business Loans

Why Choose Stacd?

-

Seize Opportunities Faster

Secure funding quickly to act on growth opportunities like bulk inventory purchases or market expansions. -

Bridge Cash Flow Gaps

Handle seasonal fluctuations, delayed payments, or unexpected expenses effortlessly. -

Protect Your Assets

Access unsecured financing without risking your business or personal property. -

Build a Stronger Financial Future

Both UBLs and business credit cards contribute to building a positive credit history, unlocking larger funding opportunities as your business grows.

Get in Touch

Ready to Elevate Your Business?

Stacd is committed to providing financial tools that work as hard as you do. Whether it’s Business Credit Cards or Unsecured Business Lines, we’ll help you achieve your goals with flexibility, speed, and confidence.

Your business’s potential is limitless—let’s ensure your funding options are, too.

Location

14747 N Northsight Blvd Suite #114, Scottsdale, AZ 85260 is address phone is 479 657 2894

Make A Call

479 657 2894